What happens to your remaining capital credits when you die?

Pioneer offers a few options for the handling of capital credits after you have passed. The method chosen determines the pace at which the credits will be retired and to whom the checks can be made payable.

If a member or former member dies, any remaining capital credits accumulation is a part of the estate and is assignable to the heirs or beneficiaries. Capital credits paid after a member has passed is considered a special retirement, as opposed to a general retirement Pioneer has been doing annually for 40 years.

The traditional method of retirement upon death is through an estate – capital credits are an asset subject to probate. The process begins once we are notified of the member’s death.

The executor or administrator of the estate will need to provide a copy of the death certificate and proof of his/her appointment by the court. We will then send an option form to be completed.

The administrator of the estate determines whether the capital credits are to be assigned and retired with the normal retirement cycles, or whether an immediate discounted, net present value distribution is preferred.

The discounted amount is calculated based on the rotation cycle number of years in place at the time of death. If the capital credits are assigned, the subsequent checks will be made to the individuals named in the assignment. If the immediate discounted refund is chosen, the check must be made out to the estate.

Sometimes no appointment of an executor is made and individuals handling the affairs of the deceased often choose to file a court document requesting relief from administration. There is a cost to file which can vary by county, but if relief is granted, the assets can be handled without going through probate. Pioneer capital credits can qualify for this process

If the gross amount of capital credits is $4,000 or less and the applicant is the deceased member’s surviving spouse or the person who has paid the burial expenses, they can apply for the retirement without a relief from administration document. A copy of the paid invoice for burial expenses is required. The choice can still be made as to whether to have the capital credits assigned or to take a discounted, net present value payout. The check will be paid out to the estate.

Capital credits can also be paid to a deceased member’s qualified trust. Qualified means it is a revocable trust and the person(s) to whom it belongs have reserved the right to revoke or amend the trust. It is important to include your cooperative capital credits as an asset of the trust. Not doing so is the most common obstacle we see in trying to retire the capital credits in this type of scenario. If they are not included, the capital credits are viewed as a probatable asset and must revert to a traditional estate process.

The most common way to ensure your capital credits are part of your trust is to place your electric service account in the trust’s name, rather than an individual’s name. If you have an existing account, the name it is under can be changed to the trust and the existing capital credits would be assigned to it. When the application for the retirement of capital credits is approved at death, the payment will be made to the trust.

One retirement method is the option to designate a Pioneer Payable on Death (POD) Beneficiary. As with a trust, it enables a member to make choices about the capital credits prior to their death.

A member can complete a POD form designating both primary and secondary beneficiaries. Under this method the discounted, net present value of the capital credits will be distributed equally in the name of each primary beneficiary.

For example, if a member has designated three primary beneficiaries, each will receive one-third of the discounted amount. If one of the three has already passed, the remaining two beneficiaries will each receive half of the discounted amount. The capital credits do not pass to secondary beneficiaries unless all primary beneficiaries are deceased.

This POD method can also be used with a trust by designating the trustee(s) of the trust as beneficiaries.

Members may designate up to four primary and four secondary beneficiaries at no cost. Beyond that number, a $30 fee per additional named beneficiary will be assessed. The fee helps cover the administrative costs associated with processing paperwork and payments for additional individuals.

In addition, it is up to the member to keep the information on the POD form current. This would include mailing addresses of the beneficiaries. A member may change designated beneficiaries by filing a new form or may cancel a POD form by notifying the cooperative in writing. A POD form cannot be completed by a member’s power of attorney.

There are two requirements common to all the options for retirements at death by Pioneer. The first is that any outstanding balance on a member’s account must be paid prior to the retirement of capital credits. If the account is not cleared, the credits will be held against the debt. The second requirement is that the account must be taken out of the deceased member’s name. If the property will be sold eventually, we recommend the estate administrator consider putting the electric account in his/her name temporarily.

What method is right for you?

The type of Pioneer membership one has may influence the choice for how capital credits will be paid out after death. In the case of a membership in one person’s name, upon death the capital credits would be available for assignment or discounted, net present value to any estate heirs or to designated beneficiaries if already on file with Pioneer.

In a joint membership, half of the total capital credits would be available to be handled under one of the options.

For example, John and Jane Member have a joint membership and $3,000 in accumulated capital credits. When John passes away prior to Jane, his half of the capital credits ($1,500) are available. If he has named Jane or someone else as his primary beneficiary, that person would be eligible to receive the discounted amount from that $1,500. The other $1,500 would remain on an account opened in Jane’s name only and would be retired under our general retirement process each year until she passes. At that time, whatever her balance at the time of death would be processed to her heirs under our available options and policies. If he didn’t complete a POD form, John’s half of the capital credits would move through the traditional estate process.

Another type of joint membership available in the cooperative is a joint membership with spousal right of survivorship.

In this case, John passes before Jane and all the capital credits automatically transfer into her name solely. She cannot take a discounted, lump sum distribution but would continue to receive refunds during the general retirements from the total $3,000. Upon her subsequent death, any remaining capital credits would be processed under our available options and policies. This type of joint membership is only available to married couples.

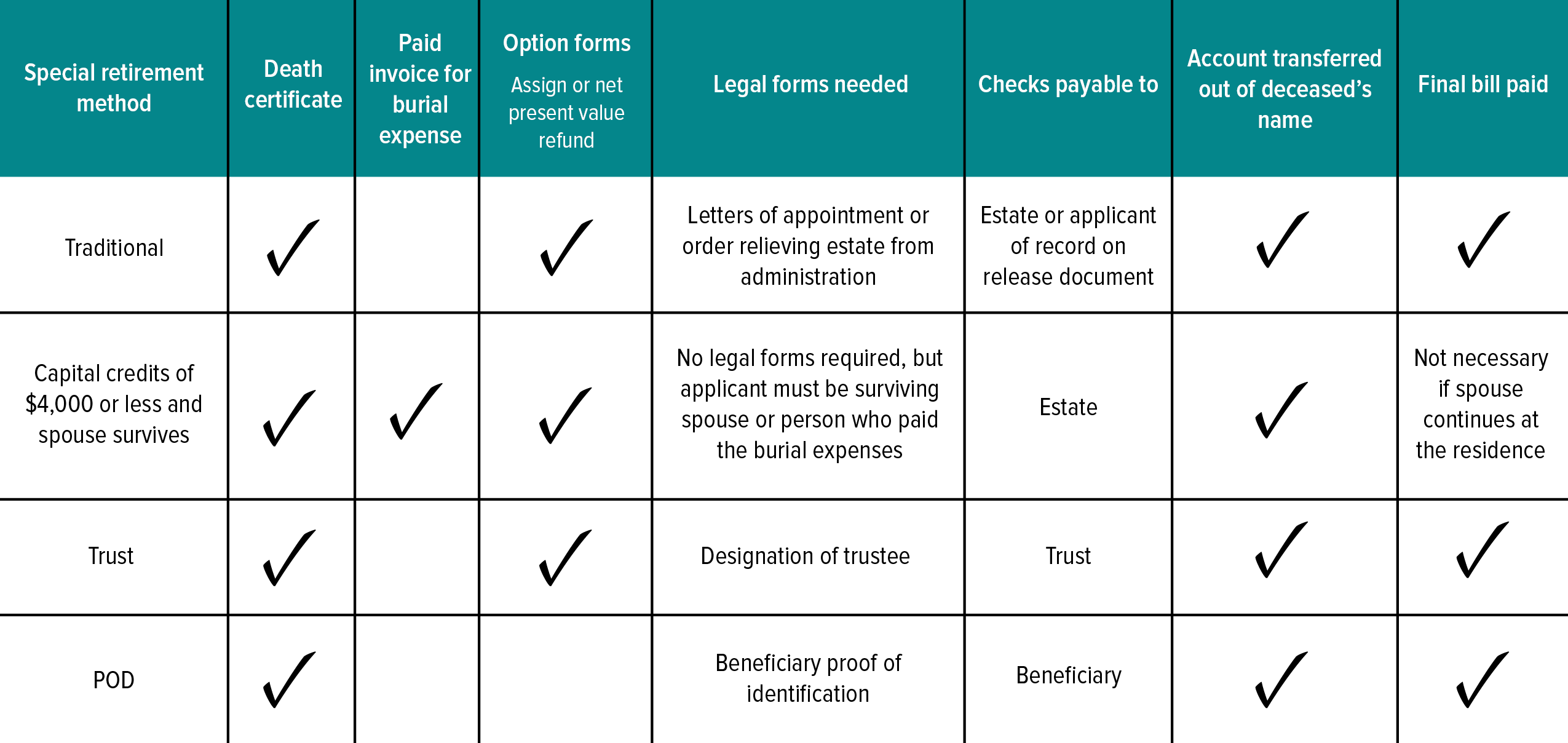

There are variations in the documentation that must be submitted for the retirement methods. All require a death certificate as proof of the member’s passing.

What happens if no one claims your capital credits after you die?

Unclaimed capital credits of deceased members are subject to forfeiture just as general retirement capital credits are. There are times we do not learn of a member’s death until years afterward. Once we know and the process to refund the capital credits begins, the heirs have one year to complete the option form and other paperwork. It’s a good idea to mention to those who will be responsible for your affairs after death that you are or were a Pioneer member and there could be capital credits among your assets to be claimed.

If you have questions regarding the various methods of handling capital credits at death, please contact our offices. Planning and communication now about your wishes when you are gone, could be very helpful to your family or heirs.

© 2024 Pioneer Electric Cooperative.

All rights reserved. | Web design by Jetpack